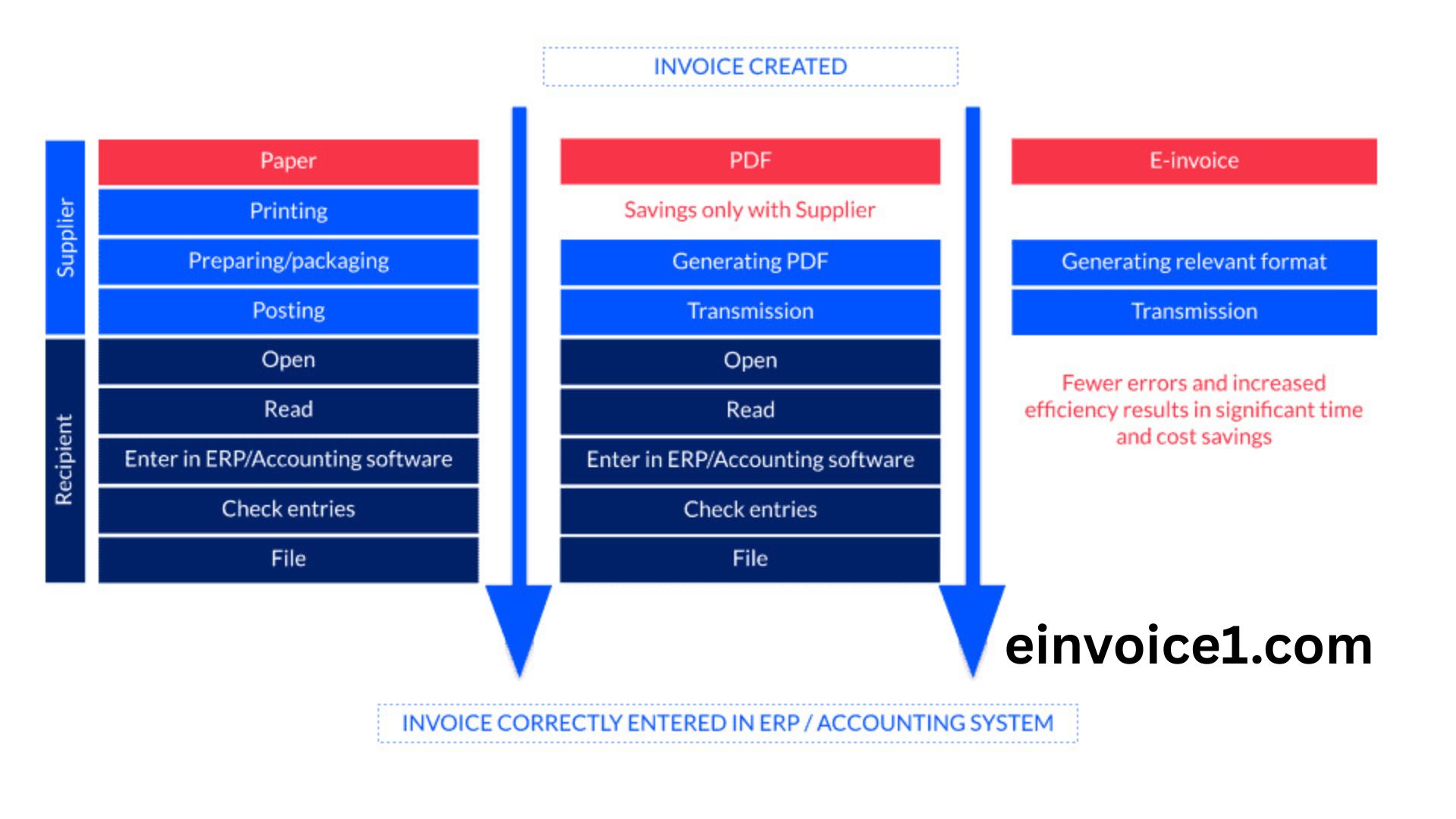

Digitization of business in India has brought about a revolution in terms of companies managing billing and taxation. The best development that has affected the most is the implementation of e-Invoice Portal Login system that simplifies the procedure of electronic invoicing based on the Goods and Services Tax (GST) framework. This system will provide transparency, lessen tax evasion and efficiency in reporting transactions. Knowledge of the e Invoice Portal Login process, its advantages and navigation may help business to remain in compliance and enhance working processes.

What is the e-Invoice Portal?

The e-Invoice Portal is a governmental web site created by the Goods and Services Tax Network (GSTN). It promotes the creation, authentication, and filing of electronic invoices (e-invoices) to businesses that are registered under GST. Each invoice issued on this portal is assigned with an Invoice Reference Number (IRN) that promotes the authenticity and reporting of the same in real time to the GST and the e-way bill systems.

The e Invoice Portal Login is the entry point where the taxpayers can access the system and submit invoices and perform all the associated operations effortlessly.

Importance of the e-Invoice Portal Login

The e-Invoice Portal Login is crucial to the enhancement of business transparency and ease of compliance. It makes sure that all the B2B transactions are digitized in real-time. The portal system is integrated with the GST system to produce data which is accurate and error-free by removing the manual errors and duplications of information.

As a company, accessing the e-Invoice Portal would enable immediate access to such features as invoice creation, cancellation, and monitoring. It also assists them to keep in check with the rules to avoid being subjected to fines caused by violation.

Step-by-Step Guide to e-Invoice Portal Login

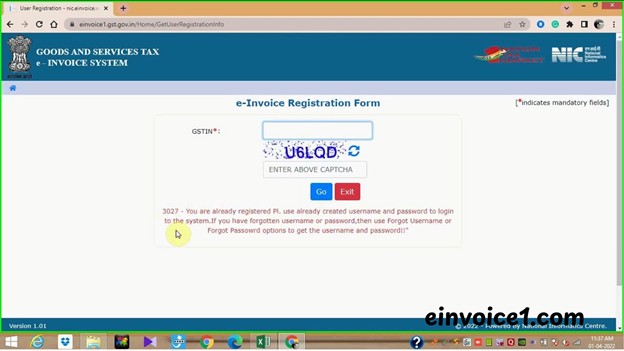

Here’s how you can easily log in to the e-Invoice Portal and start generating e-invoices:

- Visit the Official Portal

Go to the official e-Invoice Registration Portal at einvoice1.com This is the primary gateway for taxpayers to manage their e-invoice activities. - Navigate to the Login Page

On the homepage, click on the Login option located at the top-right corner. You’ll be redirected to the e Invoice Portal Login - Enter Your Credentials

Provide your GSTIN, Username, and Password in the respective fields. These credentials are the same as those used for your e-way bill or GST portal. - Enter Captcha Code

Input the captcha code displayed on the screen for verification purposes. - Click on Login

After entering all details correctly, click on Login to access your dashboard.

Once logged in, you’ll have access to a range of features related to e-invoicing.

Features Available After e-Invoice Portal Login

After completing the e-Invoice Portal Login, users can access several useful features that simplify the invoicing process:

- Generate IRN (Invoice Reference Number): Create a valid electronic invoice by uploading your invoice details in JSON format.

- Cancel IRN: If an invoice has been generated incorrectly, users can cancel it within 24 hours.

- View and Track Invoices: Access all generated invoices and monitor their current status.

- Bulk Upload Option: Ideal for large businesses, allowing multiple invoices to be uploaded in a single session.

- API Integration: Businesses using ERP systems can integrate their software directly with the portal for automatic IRN generation.

- Download Reports: Users can download invoice summaries and reports for compliance and audit purposes.

Benefits of Using the e-Invoice Portal

The e-Invoice Portal Login system offers numerous benefits to both businesses and tax authorities:

- Accuracy and Standardization

All invoices generated through the e-Invoice system follow a uniform structure, reducing human error and ensuring data consistency. - Reduced Compliance Burden

Since e-invoices are automatically shared with the GST portal, businesses no longer need to manually upload invoices for returns. - Faster Input Tax Credit (ITC) Claims

Automatic data transfer ensures that the buyer’s ITC details are reflected promptly, improving credit reconciliation. - Real-Time Authentication

Each invoice gets verified instantly by the Invoice Registration Portal (IRP), ensuring authenticity and preventing fraudulent activities. - Seamless Integration with E-Way Bill System

The e-Invoice Portal Login connects directly with the e-way bill system, allowing automatic generation of transport documents. - Enhanced Transparency

The government gains better visibility into B2B transactions, reducing tax evasion and improving overall compliance rates.

Who Should Use the e-Invoice Portal?

As per GST regulations, businesses with a turnover exceeding ₹5 crore in any financial year are required to generate e-invoices. However, even smaller businesses can voluntarily use the e Invoice Portal Login to improve efficiency and compliance readiness.

The portal is designed for:

- Registered taxpayers under GST

- Businesses generating B2B or export invoices

- Companies integrating ERP or accounting systems for automated invoicing

Common Issues with e-Invoice Portal Login and Solutions

- Invalid Credentials

Ensure your GSTIN, username, and password are correct. Reset your password if you face repeated login failures. - Captcha Not Working

Refresh the page and try again. Sometimes, captcha verification fails due to browser cache. - Portal Unavailable

The e-Invoice Portal may undergo maintenance. In such cases, check the official GST Twitter handle for updates. - Slow Response Time

Clear your browser cache, use updated software, or try logging in during non-peak hours for smoother access.

Security Measures for e-Invoice Portal Login

The e-Invoice Portal Login provides several levels of protection to the security of the data. User IDs and passwords are coded, and all the operations are carried out via secure means. It is prudent to exit all the sessions and one should never disclose the details of logging in with people who may not be authorized.

Businesses also need to update the registered email and mobile numbers periodically to get alert and notifications at the GST system.

Integration with Accounting Software

Recent ERP and accounting programs such as Tally, Zoho Books and SAP have direct integration with the e-Invoice Portal. This gives automatic generation of IRN and real time synchronization of data. It will remove human involvement, enhancing precision and expediency in the compliance reporting.

APIs offered by the portal help businesses to integrate easily such that all invoices obtained are in accordance with the GST regulations.

Future of e-Invoicing in India

The introduction of the e Invoice Portal Login system is a big step towards the process of digitalizing taxation in India. The government is in the process of upgrading the system to suit more taxpayers and become easier to use. With time, it is perhaps expected that the process can be extended to B2C invoices and sophisticated analytics of fraud detection.

In the case of businesses, it is important to keep up with the changes in the rules of e-invoicing. The compliance and optimization of workflow can be ensured through regular training and awareness of the e-Invoice Portal login procedure.

Conclusion

E-Invoice Portal Login is an important milestone in the process of converting India into a completely digital tax environment. It makes compliance easier, facilitates transparency, and is compatible with the already existing GST and e-way bill systems. Regardless of whether you are a small business or a large enterprise, it is important to understand how the portal works so that you can more easily handle invoices and cope with government regulations.

Learning to use the e Invoice Portal Login allows, on the one hand, businesses to comply with legal norms but, on the other hand, to use technology to enhance efficiency, save money, and gain increased trust from stakeholder.