Documentation in the sphere of contemporary business is crucial in preserving transparency, accuracy and tax legalities. Among all the documents used in financial transactions, the tax invoice bill stands out as one of the most critical. It is considered to be evidence of a sale as well as a legal document that helps businesses to receive input tax credit and follow the government rules. Whether you are a small business owner, a freelancer, or an accounting professional, understanding how the tax invoice bill works can save you time, money, and unnecessary legal trouble.

What Is a Tax Invoice Bill?

A tax invoice bill is an official document issued by a registered seller to a buyer during the sale of goods or services. It shows the specifics of the transaction, the description, quantity and price, the taxes to be paid and the amount that has to be paid. This document is not only aimed at confirming the sale but it is also intended to provide a legal record against taxation.

This bill assists the seller and the buyer in ensuring that records of transactions made are correct. To the seller, it serves as a testimony of taxation that he/she should pay to the government. To the buyer, it is an acceptable document to claim input tax credit which is likely to cut their total tax bill.

Importance of a Tax Invoice Bill in Business

Every business dealing in taxable goods or services must issue a tax invoice bill. This is necessary to have the tax being collected and remitted properly to the authorities. The existence of this document makes a transaction invalid to tax purposes.

The tax invoice bill also enhances transparency between buyers and sellers. It displays the amount of tax levied and the customers can get to know how the overall price is made up. Furthermore, it allows the government officials to monitor taxable operations, thus averting tax evasion in the economy and enhancing economic justice.

Key Components of a Tax Invoice Bill

A properly prepared tax invoice bill contains several important elements. Although the exact format may differ based on the country and the tax laws, the following elements are generally incorporated:

- Invoice Number and Date – This is a distinct identifier that assists in keeping good records.

- Seller Information – Name, address, tax registration number (eg. GSTIN or VAT number).

- Buyer-Information- Name, address and registration number where applicable.

- Description of Goods or Services – Detailed list of what is sold or services provided.

- Quantity and Unit Price – This is necessary to find out the total value.

- Tax Rate and Amount – The value of tax imposed and the actual amount imposed.

- Total Amount Payable – It is the amount of value of goods or services to be paid along with taxes.

- Terms and Conditions – Method of payment, date of payment and other notes.

A well-designed tax invoice bill not only ensures compliance but also builds credibility with clients. It is business professionalism and precision.

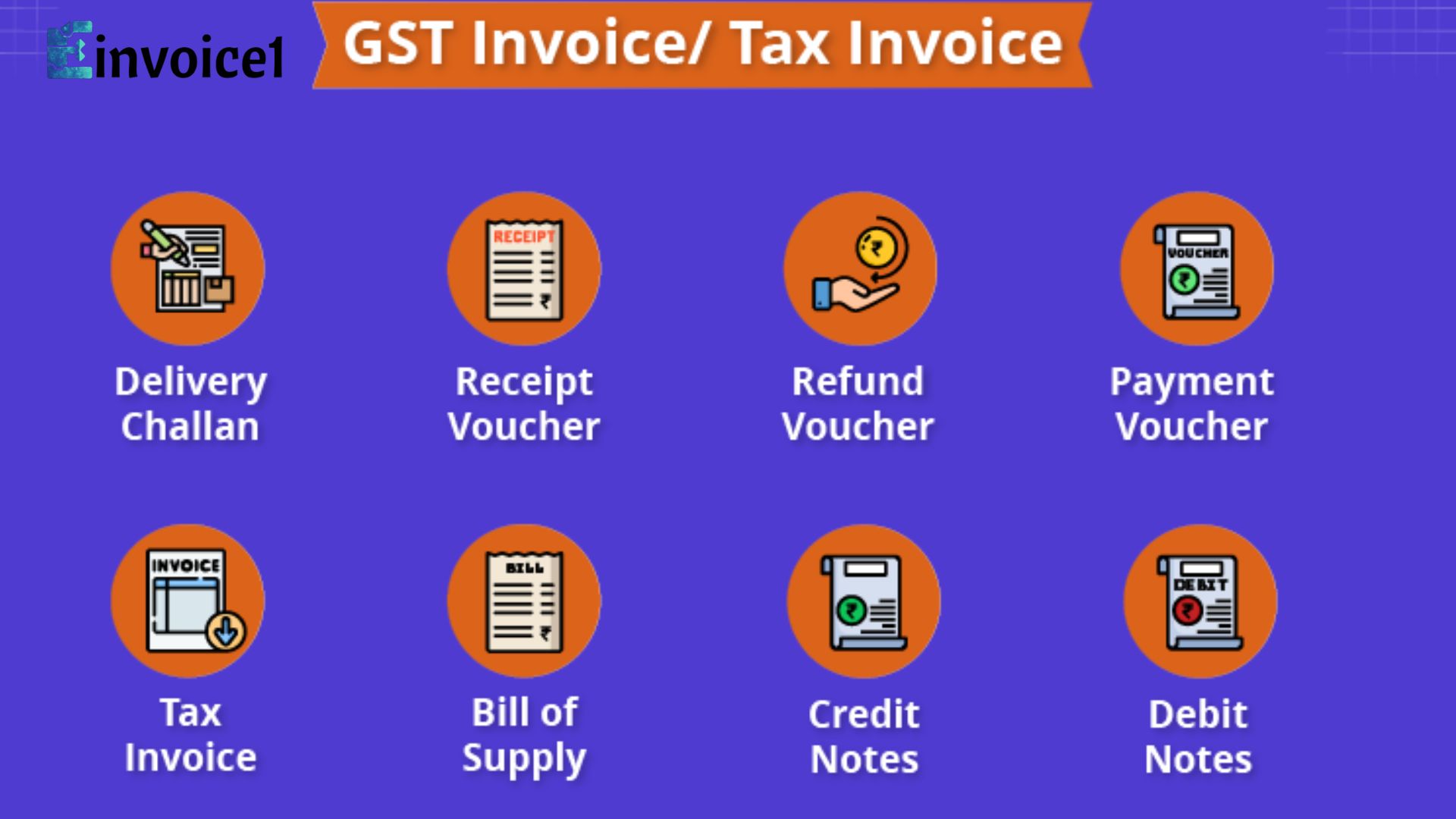

Types of Tax Invoice Bills

Depending on the nature of the transaction, there can be several types of tax invoice bill formats:

Standard Tax Invoice: This is released when the goods or services have been sold to another registered business which could claim input tax credits.

Simplified Invoice: Simplified invoice is used when the transactions are small in nature, typically below some predetermined value.

Proforma Invoice: Mailed in advance of the sale, meaning an estimate or quotation to the buyer.

Credit and Debit Notes: The amendments are performed after the initial issuance of the invoice to rectify or modify the price.

Understanding which type of tax invoice bill to issue helps ensure that the business follows the right procedure under tax laws.

How to Create a Tax Invoice Bill

Creating a compliant tax invoice bill involves both attention to detail and the use of reliable invoicing systems. Most companies resort to the use of digital tools or accounting software to automate the process of creating invoices and maintenance of records.

The following is a step-by-step procedure of making a tax invoice in the right way:

- Add Business Information: This is where the legal name, address, and tax registration of the seller should be given.

- Add Buyer Information: Include all the information about the buyer so that both parties can have a valid invoice.

- Insert Invoice Number and Date: This eliminates the chances of losing trace and bookkeeping.

- List Goods or Services: Give descriptions in detail including prices and quantities per unit.

- Use the Right Tax Rate: Use the right amount of tax, either GST, VAT or sales tax.

- Divide the Total: Sum up the amount of goods and tax.

- Including Payment Details: state payment methods, bank data, and dates.

Online invoicing systems are able to automatically pay taxes, create PDF copies of invoices, and send them directly to customers. This reduces the human error and enhances efficiency.

Laws and Legality

Issuing a tax invoice bill is not optional for registered businesses — it is a legal requirement. Failure to issue (or wrong issuance of) invoices may lead to fines and loss of input tax credit eligibility.

As an illustration, in the provisions of the Goods and Services Tax (GST) in most countries, every registered supplier has to provide tax invoice of all the taxable supplies. The invoice should be issued within a given period of time usually prior to delivery or during delivery. Otherwise, there is the risk of paying fines or being barred of some tax benefits.

Therefore, businesses must stay updated on the latest regulations governing the format and contents of a tax invoice bill. The automated invoicing software makes it possible to adhere to the evolving tax regulations without any manual work.

Online Change and E-Invoicing

As technology is on the increase, governments are coming up with e-invoicing systems to make the tax reporting process easy and more accurate. An electronic tax invoice bill is generated digitally and validated through government portals. This helps to minimize fraud, increase transparency and enables data to be shared smoothly between the businesses and the tax authorities.

E-invoicing is also designed to be connected to the accounting systems and reduce the errors related to manual entries, and provide the financial records with real-time updates. In the case of small and medium enterprises, e-invoicing will reduce administrative hassles, as well as expedite payment.

Benefits of Maintaining Proper Tax Invoice Bills

Maintaining accurate and well-organized tax invoice bill records offers numerous benefits to businesses:

Tax Compliance: Makes sure all the transactions are well documented in order to be audited and filed.

Input Tax Credit: Buyers are eligible to receive credit on taxes collected on purchases and this decreases the total tax liability.

Professionalism: Garners confidence among the clients through open billing.

Lessened Inaccuracy: There are no mistakes in invoicing systems due to automation.

Improved Cash Flow Management: Clarity of payment terms assists in tracking of receivables effectively.

Besides, records kept electronically are more accessible and the past invoices can be accessed easily whenever required to reconcile them or verify them legally.

Common Mistakes to Avoid

Even experienced businesses can make errors while creating or managing a tax invoice bill. These are some of the pitfalls to avoid:

- Lack of or wrong invoice numbers.

- The use of incorrect tax rates, or omission of tax breakdowns.

- Failure to appropriately include buyer details.

- Slowness in issuing invoices.

Inability to keep digital copies which can be audited

Prevention of such mistakes leads to compliance as well as indicates efficiency and professionalism in the operations.

Use of Automation in Invoicing.

The automation has totally changed the aspect of how businesses bill. Modern accounting tools generate tax invoice bill templates automatically, calculate tax, and send them to customers instantly. The systems also have the payment gateways which are easy to use by clients who want to pay online.

Automated systems minimize human data entry, identify cases of missing data, as well as monitor late payments. They also assist in the audits by ensuring that there are detailed logs of all invoices issued. This online revolution is introducing smarter and more open business practices globally.

Tax Invoice Systems Future

Invoicing is evidently going digital. With blockchain, AI, and integrated financial software, the next generation of tax invoice bill systems will be more secure, transparent, and interconnected. It will soon be a common practice to have real-time tracking of tax payments and automated filing.

The advantage of businesses that will implement these technologies early is that they will be more efficient and have less compliance concerns, as well as better financial insights. The governments are also promoting the use of digital invoicing to facilitate easier way of administering taxes as well as reduce cases of fraudulent claims.

Final Thoughts

In today’s competitive and regulated business environment, understanding the tax invoice bill is essential for smooth operations. It is not simple paper; it is the legal foundation of all the financial operations. The correct maintenance, issuing, and recording of tax invoices can keep businesses in the game, allow them to claim tax credit, as well as present an image of professionalism. With new rules and regulations, the adoption of technology and automation will be inevitable in the effective management of invoices. An invoicing process that is transparent and compliant will help to build credibility as well as improve the financial health of a business. In conclusion, mastering the process of creating and maintaining a tax invoice bill ensures that businesses stay ahead in compliance, accuracy, and financial management. It forms the basis on which trust, transparency, and long-term success are established.