The world of business and governments is going electronic in the digital era, and is introducing electronic means to simplify financial transactions, assure compliance, and enhance transparency. Among the most important advances in this regard, the e invoice system should be mentioned. Contrary to traditional paper or even the simplest digital invoices, an e-invoice is a form of structured data created in a standard format, which can be easily integrated among the buyer, seller and regulatory powers.

The e invoice system is crucial especially on tax compliance, financial transparency and efficiency on the business operations. It is eliminating redundancy, fraud, and standardization, and assists governments to monitor transactions in real time. This discussion examines the design, functionality, advantages, issues and future perspectives of e invoice system with a wider perspective of the system to business and economies in general.

Understanding the e-Invoice System

The e invoice system can be defined as a part of an organized invoice format which is created electronically and confirmed by a central portal (which is usually provided by the tax authorities) and then distributed to the buyer, seller, and government database.

Important Characteristics of the e-Invoice System

Formatted Standardized: Typically on global standardized schemas such as XML or JSON.

Unique Invoice Reference Number (IRN): No individual invoice is validated, rather a government-approved system assigns an IRN to it.

Real-Time Reporting: The transactions are reported to the tax officials in real-time.

Interaction with GST/Tax Portals: Secures a smooth compliance to businesses.

Interoperability: Standardised nature provides compatibility in the various ERP (Enterprise Resource Planning) and accounting systems.

The Need for Invoice Systems

Conventional invoicing systems tend to experience problems such as manual errors, fraudulence claims, evading taxes and lack of correspondence. Under-reporting and fake invoicing reduce the income of governments in terms of taxation. Other inefficiencies that affect businesses include duplicate data entry, inability to update in real time and difficulties in reconciliation.

These concerns are overcome with the e invoice system by assuring that:

- Financial openness of business-to-business (B2B) and business-to-government (B2G) deals.

- Creative input tax credit (ITC) claims.

- Improved data analytics to enable governments monitor fraud and compliance.

- Less paperwork and less operational delays.

Analytical Benefits of the e-Invoice System

The system would make sure that all the invoices prepared are reported to the tax authorities. This minimises the risk of counterfeit invoices and false ITC claims. The e-invoice structure places a powerful deterrent to tax evasion by verifying invoices on-the-fly.

Governments and businesses can access real time and accurate invoice data. Buyers are able to check the invoice authenticity immediately and regulators can spot an anomaly or suspicious pattern in the shortest possible time.

The e invoice system does not require duplication of data to be entered into various platforms such as the GST returns, e-way bills, or accounting software. Businesses can save on time, minimize errors and enhance efficiency in the workflow since the data flows smoothly.

Even though the initial implementation expense might be great, in the long run, businesses make money by minimizing paperwork, increasing the speed at which reconciliation occurs, decreasing the number of disputes, and simplifying operations.

The implementation of e-invoice systems promotes the shift to the digital environment. Companies invest in ERP upgrades, automation systems, and analytics systems, which make the economy more digital.

There are difficulties in the Implementation of e-Invoice Systems

Technological Barriers

SMEs might not have the infrastructure to use e-invoicing. Connection with existing ERP or accounting systems may prove to be expensive and time consuming.

Compliance Burden

The system can be complicated to businesses that are not well versed with online procedures. Firstly, it can be difficult to train employees, to adapt workflows and to make sure they are accurate.

Connection and Infrastructure Problems.

In less developed areas with low internet penetration or digital connectivity, real time reporting can be a challenge.

Data Privacy Concerns

All invoice data is channeled via centralized government systems hence raising the issue of data security and privacy. They should put in place safeguards that will help in securing sensitive business information.

Technical Failures and System Downtime.

Any failure of the central portal can interfere with invoicing and business. The high-availability systems and backup measures are vital.

Global e-Invoice systems comparison

There are some countries that have been successful in adopting e invoice, and their experience can be very informative.

India:

o Introduced e-invoice to companies having a specific turnover over a threshold.

o Integrated with GST portal and e- way bill system.

o Defined with JSON schema.

Mexico:

o One of the e-invoicing pioneers.

o It uses CFDI (Comprobape Fiscal Digital por Internet) system.

o Has greatly minimized tax evasion.

European Union (EU):

o Implemented B2G e-invoicing, which became compulsory in the public procurement.

o Consistency of member states.

Brazil:

o Employs NF-e (Nota Fiscal Eletronica).

o Transactional reporting and approval that is real-time.

China:

o Adopts fapiao (electronic invoice system).

o Takes the form of invoice and tax receipt, and is strictly regulated by tax authorities.

In this international review, it is indicated that there is variation in models, but the objectives are similar: transparency, compliance, and efficiency.

Economic and Business Implications

For Governments

Increase in Revenue: e-invoice systems enhance the effectiveness of tax collection by cutting down on leakages and fraud.

Data-Driven Policy Making: Governments have access to large volumes of data around the transactions, which can be more predictive and policy policy-making.

For Businesses

Competitive Edge: Digital compliant businesses will be more efficient and trusted in the global supply chain.

Quicker Payments: Invvoices are standardized which enhances better reconciliation and shortens payments.

Audit Readiness: Organized data makes auditing a much easier task that requires less time to accomplish and is more precise.

For Consumers

Transaction Authenticity: End-users enjoy greater trust and less fraud in invoices.

Analytic Effect on SMEs and Large Business

Large Enterprises: These normally have well-developed ERP systems, which are easier to integrate. To them, e-invoicing increases efficiency and compliance mostly.

Small and Medium Enterprises (SMEs): SMEs initially struggle to embrace technology, but in the long run, they enjoy automation, fewer errors in compliance, and access to digital finance.

The system can burden the SMEs at first but bring long-term benefits by driving them into digital transformation.

Future Outlook of e-Invoice Systems

Global Standardization:

A greater number of countries will likely converge their e-invoice systems on international standards such as Peppol to help deliver cross-border trade.

The role of Artificial Intelligence (AI) and Automation:

AI also will make invoice matching, fraud detection, and predictive analysis easier for businesses and governments.

Blockchain Integration:

Invoice information can be secured with the help of blockchain to be immutable, traceable and more secure.

SME-Friendly Platforms:

Governments can also open invoicing portals, which are inexpensive or free to SME to encourage its use.

Digital Payment Systems:

The e-invoices are connected with real-time payment systems, which may increase faster settlements and positively affect the cash flow.

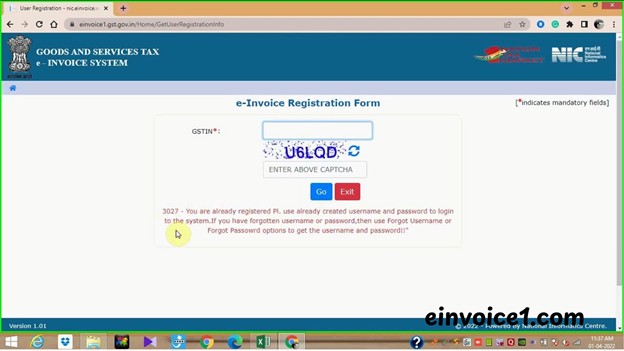

Case Study Analysis: India E-Invoice System

In 2020, India introduced its e invoice system under GST and initially covered large companies but progressively rolled it out to small companies. By 2023 companies whose turnover exceeded [?]5 crore were required to produce e-invoices.

Key Analytical Outcomes:

False invoice fraud was reduced.

There was an improvement in compliance because of real-time reporting.

Initially, SMEs were not very comfortable with this but over time, they embraced this technology by way of free invoicing provided by the government.

Redundancy was lessened through integration with GST return filing and e-way bills.

The case demonstrates that a gradual process is an effective way to balance business preparedness and compliance.

Conclusion

E invoice system is a revolutionary change in the way businesses and governments handle invoicing and taxation. It is also able to develop a transparent and efficient ecosystem by standardizing, validating, and reporting invoices in real-time. The advantages are obvious: less fraud, compliance, better collection of the revenue, and efficiency of work. Nonetheless, issues such as technology adoption, data security and infrastructure need to be tackled to make the implementation smooth. In terms of long-term strategic thinking, e invoice system cannot be viewed as a compliance tool, but rather a driver of digital transformation, allowing for building trust and transparency in business transactions and enhancing the basis of contemporary economies. With the increasing number of countries that have embraced and improved their models, e-invoicing will be transformed into the international standard of financial and tax compliance.