Introduction

In the modern hectic digital economy, online money management is not just an option, it is a must. The vein of this financial revolution runs through the e-invoice, a standardized digital bill that is rapidly changing business payment issuing, sending, and tracking. But before you can harness the power of instant invoicing, automated tracking, and streamlined cash flow, there’s one crucial first step: successfully navigating your e invoice portal login. A single point of entry gives you access to a more efficient accounting workflow that can, however, become stressful by issues with forgotten passwords, the system error, or access problems. This step by step guide is meant to dispel the myths that surround this process. We are here to guide you step by step, starting with the preparation process to troubleshooting problematic logins to make sure that your experience of logging in is always safe, fast and effective. As a small business owner, freelancer or member of a large finance team, it is the secret to the world of financial efficiency you can unlock by mastering this login.

Key Takeaways:

- Simple solutions to some common failures during log in are proper preparation including your credentials, and a secure browser.

- Comprehension of security codes like multi-factor authentication is a must when it comes to safeguarding financial sensitive information.

- Finding out the right place to seek assistance can save your lot of time and most of the access problems will be solved within a couple of minutes.

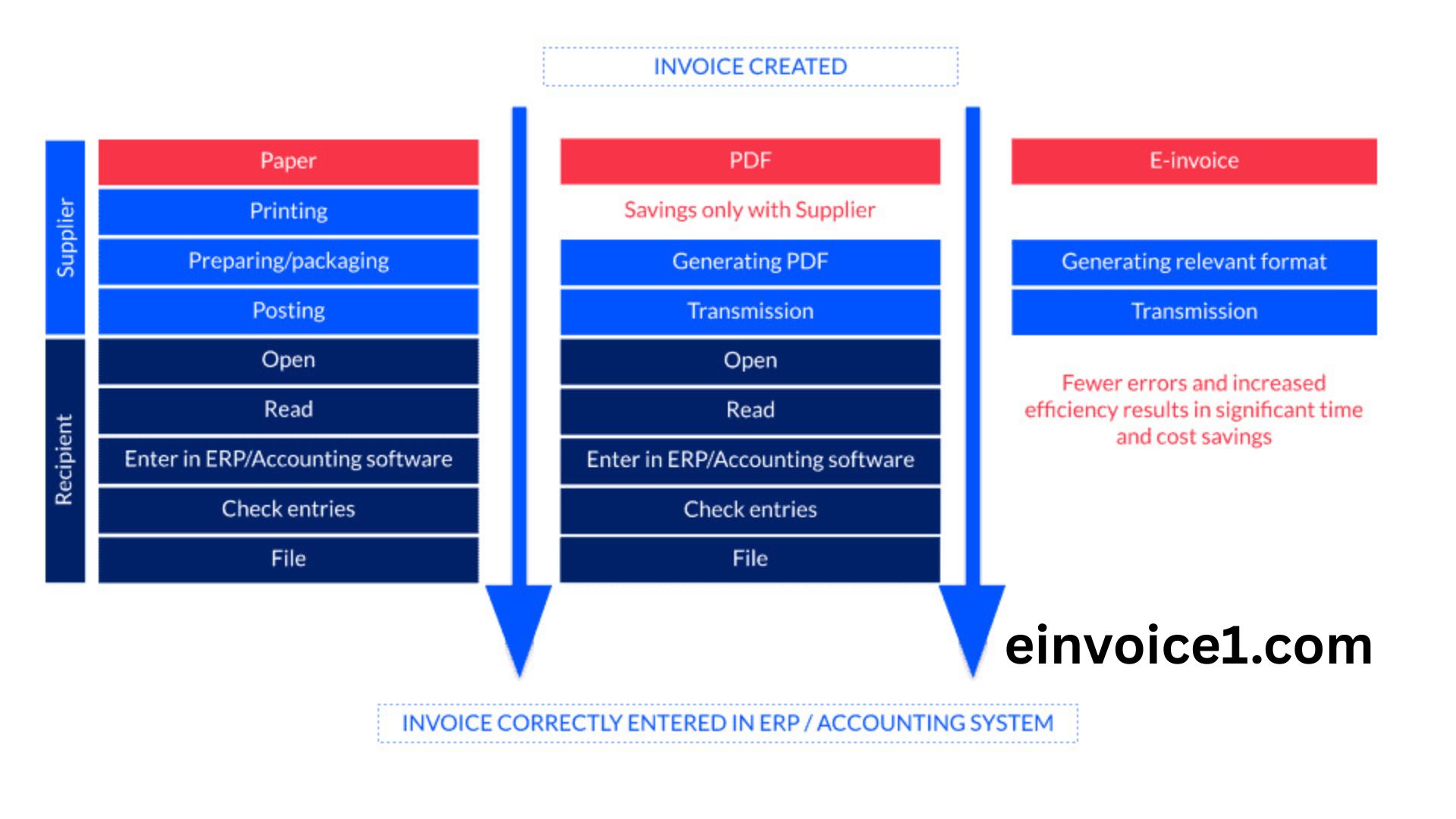

What is an E-Invoice Portal? and Why is the Login so Important?

An e-invoice portal is a secure online platform, typically provided by a government tax authority (like the IRS in the U.S. or HMRC in the UK) or a private software provider, that allows businesses to generate, validate, transmit, and manage electronic invoices. These portals are constructed with the specific legal requirements so that any e-invoice is genuine, intact, and readable. The e-invoice portal can use the login as a digital form of a checkpoint. It cannot be overemphasized how important it is. It is the main process of making sure that unauthorized staff cannot access the billing and financial information of a company. A successful login provides you with the power to create legally binding documents, view payment statuses, generate financial reports, and stay in compliance with tax imposed. A failed sign-in can stop your billing cycle, tie up payments, and cause compliance nightmares. It is the essential firewall that can prevent your financial operations from being violated by unauthorized deletion and access and you can still use the key to control the way.

Pre-Login Checklist: What You need Prepared

A flawless experience during the log-in process is nearly assured when preparation is done properly. Rushing to the sign-in page to only find out that you forgot the correct information is a simple and easily preventable mishap. Even before the tardy click to the site, can you run through this quick checklist. Make sure that you have the personal user ID or email ID with which you registered. This can be presented by the portal administrator when data is registered. Second, read your password. In case you have a password manager, be sure it is unlocked and active. Third, be aware if your portal requires Multi-Factor Authentication (MFA). In case it does, make sure that your authenticated smartphone, security key or email inbox is available to obtain the one-time code. Fourth, adopt and upgrade an internet browser such as Chrome, Firefox or Edge. Browsers that are outdated may result in unforeseen functional errors. Lastly, make sure your internet is running well. The intermittent connection can also result in connection timeouts when attempting to log into the e-invoicing portal which might give the impression that it is a since password issue when it is actually a connectivity issue.

Expert Insight: *A finance manager at a mid-sized firm shared, “We implemented a strict pre-login protocol for our team. Simply ensuring everyone bookmarked the correct portal URL and had a dedicated authenticator app on their phones reduced our login support tickets by over 70%.”*

A Step-wise Description to the E-Invoice Portal Log In Process

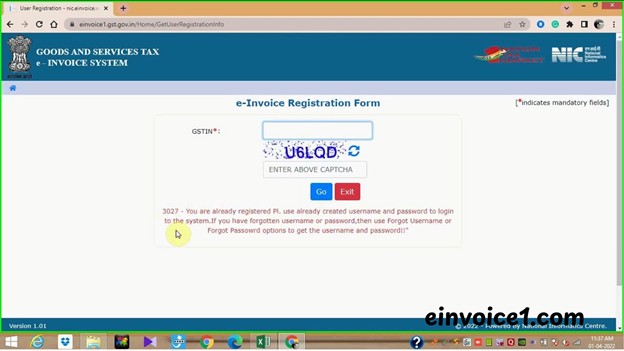

The basic log in mechanism is also standard, whereas a particular portal will have its own systems. These are the general step-by-step instructions that can be applied to the majority of platforms.

Access the Official URL Address: Do not use the links provided in any mail or other communication. Make sure you go to the official URL address by typing it directly into your browser or by using a bookmarked link. This can be prevented by not clicking on links provided in emails or messages which may result in a phishing attack.

Find the Login Area: Once on the homepage, use the button or link to find features such as Login, Sign In or Portal Access.

Enter your credentials: Enter your User ID/Username and your Password in the given boxes. Be careful of case sensitivity, and do not permit any trailing spaces.

Complete Multi-Factor Authentication (MFA): If enabled, you will be prompted to approve the login via an app, enter a code sent via SMS/email, or use a security key. This is an essential coverage measure

Launch Your Dashboard: once authenticated successfully you will be redirected to your own dashboard where you can view, create and manage your e-invoices.

Comparing Common E-Invoice Portal Types

Not all e-invoice portals are created equal. Your login experience and the portal’s functionality can differ significantly depending on who provides it. Understanding these differences helps set the right expectations.

The table below outlines the key differences between government and private provider portals.

| Feature | Government Tax Portal | Private Software Provider Portal |

| Primary Purpose | Tax compliance and legal validation | Comprehensive business invoicing and accounting |

| Login Credentials | Often linked to a general tax ID or government gateway account | Unique to the software platform; often an email address |

| Key Functionality | Validation, submission, and storage for tax purposes | Creation, sending, tracking, reporting, and payment processing |

| User Experience | Can be functional but less intuitive; updated infrequently | Typically more modern, user-friendly, and updated regularly |

| Best For | Businesses fulfilling mandatory tax e-invoicing requirements | Businesses seeking an all-in-one invoicing and financial management solution |

Troubleshooting Your Login: The Most Common Problems.

Despite the preparation, you may sometimes develop problems. This is how to troubleshoot and resolve the most common e-invoice portal login errors.

Error: Invalid Username or Password. This is the most common problem. To make sure that your CAPS LOCK key is turned off, first turn it off. Re-enter credentials carefully. In case it fails to work, use the link “Forgot Password” and reset the password. Do not press this link numerous times, it could have the effect of temporarily locking your account.

Portal will not load: Check your internet connection. Just to be sure, go to a different page. In the case that your connection is okay, there is a chance that the portal is in maintenance. Have a check in the social media/status page of the provider.

Multi-Factor Authentication (MFA) Issues: If you’re not receiving your SMS or email code, check your spam folder and signal strength. On authenticator apps, make sure the time in your phone is automatically adjusted, since a time mismatch problem can render codes invalid.

Clear your browser cache and cookies: Stored out of date information can be the subject of conflict. Otherwise, open the portal in a non incognito/test browser or use another browser.

Security: Making Login a Priority: Best Practices

The e-invoicing portal log in combines security levels of very sensitive financial data. Strict security practices are known to be critical towards ensuring that your business data are not exposed to cyber threats.

Use a powerful and different password: Do not use frequent words or phrases. Make a long (longer than 8 characters needed) password, with a variety of upper and lower letters, digits and symbols. Don not use a previously used password on another site.

Embrace Multi-Factor Authentication (MFA): If MFA is an option, enable it immediately. It presents an extra element of safety that reinforces the fact that anyone who may gain access to your password will be exponentially more difficult to break into.

Be Avoid the Phishing: Be very careful of the mails or messages which urge you to log in to the portal by clicking on a link. They are frequently frauds intended to take away your logins. Always do not go through the portal via any other route.

Log Out: Log out of the portal system completely. What might look like an obvious method of closing your session might only end up closing your browser tab

Check Account Activity: View and monitor invoices that you send and check your account activity regularly. The early detection is crucial to the minimization of damage.

According to a report by Verizon (external link to an authoritative source), over 80% of hacking-related breaches involve compromised passwords, underscoring why these practices are so vital.

Conclusion

Mastering your e invoice portal login is far more than just a technical step; it is the foundation upon which efficient, secure, and modern financial management is built. With insight into what the portal is, ready and waiting credentials, a definite step of the procedure, and resolution to the typical errors, one will shift a possible source of tension to a smooth entry. More to the point, by exercising good security practices, such as the use of different passwords and MFA implementation, you also safeguard your business against serious financial and data-related risks. This is your personal log-on to a system that will save you time, will cut errors and will improve compliance. Accept the process and you can tap the full potential of electronic invoicing and free up more time to continue growing your business and less time on paper work. Your next action plan should be using the official link to the login page of the portal to which you are to log in, as well as to keep your login data in a safe place.

FAQs

Q1: I left my e-invoice portal password. What ought I to better do?

Go to the e-invoice portal portal, and click the forgot password/reset password the link on the portal page and proceed with the emailed instructions.

Q2 I am prompted with a code after I enter my password. Why?

A: This is Multi-Factor Authentication (MFA), a critical security feature that verifies your identity using a second method, like your phone, to prevent unauthorized access.

Q3: Is it safe to save/store my login/password in my web browser?

Although easy to use with a trusted personal device, it is safer to rely on a dedicated password manager to store such important credentials as your portal login information.

Q5. Do I have access to the e-invoice portal on my mobile phone?

Yes, e-invoice portals in the majority of cases are mobile-friendly, or, to be more precise, they provide an issue of a mobile application so that the owner can log in and track the invoices using his or her smartphone.