The digital age has changed how companies conduct their invoicing, taxation and compliance. The creation of the eInvoice Portal can be seen as one of the largest steps in this transformation. The purpose of this platform was to simplify, open up, and streamline the process of creating, validating and managing invoices. In the businesses that use Goods and Services Tax (GST) regime, the e-Invoice system has become a necessity to maintain compliance and GST returns integration.

This guide will address the eInvoice Portal, its intent, benefits, how to register with the portal, features of the portal and how business people can utilize the portal effectively. Being a small business owner or a large enterprise, you will be at the forefront of compliance requirements and make small businesses more efficient by knowing how the eInvoice Portal functions.

What is the eInvoice Portal?

The eInvoice Portal is a formal government site designed to assist business to create and validate invoices through the GST regime digitally. Companies can create standardized e-invoices, which are authenticated by the Invoice Registration Portal (IRP), instead of preparing invoices manually and reporting invoices in GST returns separately. After being validated, an invoice is assigned a unique Invoice Reference Number (IRN) and QR code.

This makes sure that all invoices are standardized, verifiable and they are easily incorporated with GST returns, e-way bills and accounting software.

Why Was the eInvoice Portal Introduced?

The e-invoice system was initiated by the Government of India to address several problems of business and tax collection:

* Eliminate fake invoices: Fraudulent invoicing was a major issue, and the eInvoice Portal ensures each invoice is verified and registered.

* Less compliance overhead: Businesses no longer require reporting similar invoice information in two or more locations like GST returns, as well as, e-way bills.

* Standardization: Various accounting and billing programs to generate non-uniform invoices. The portal imposes a standard format on an industrial basis.

* More transparency: It is simple to track invoices by tax authorities and identify abnormalities.

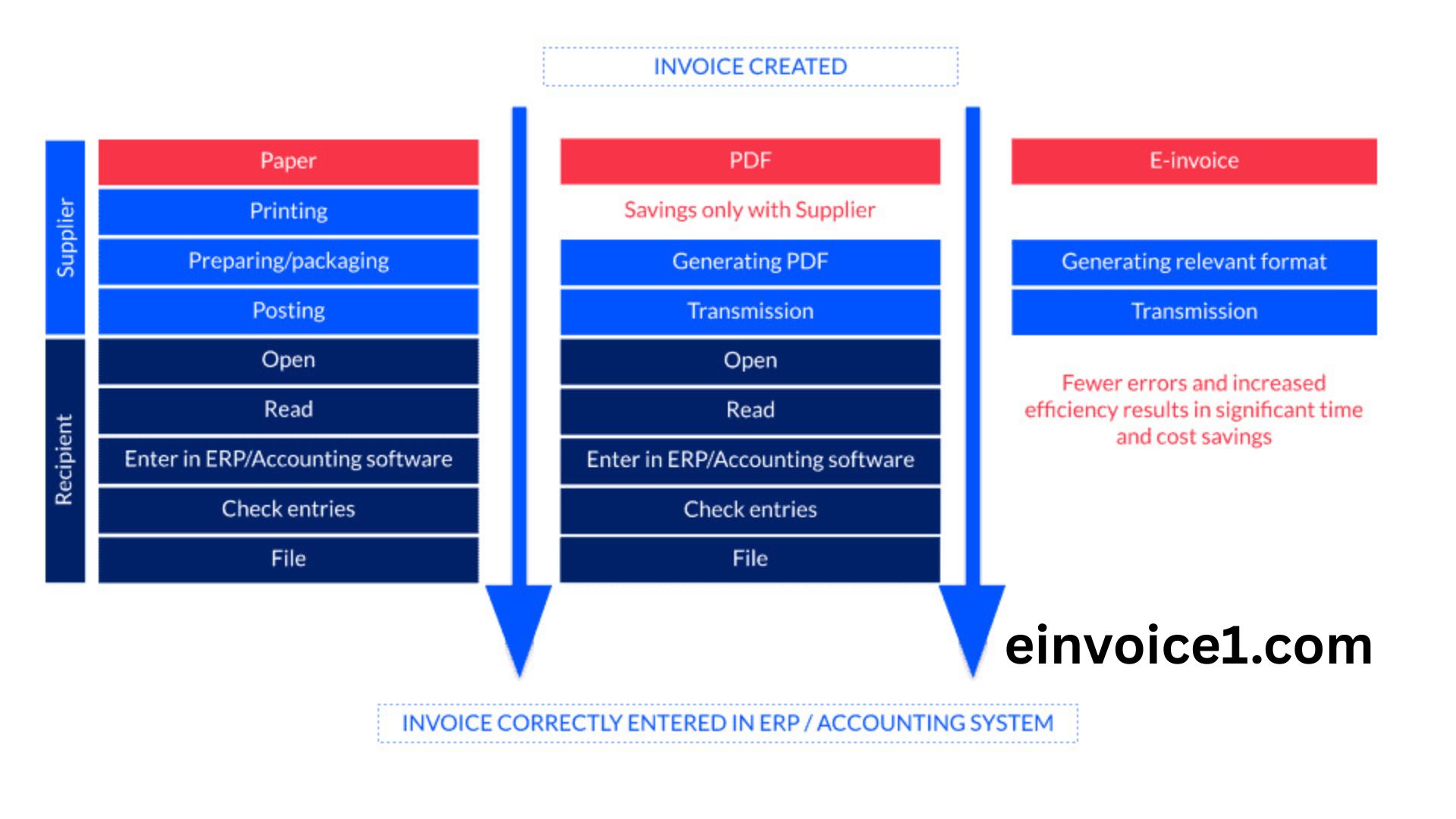

* Time efficiency: One is time efficiency since automating invoicing causes less errors, less paperwork, and less manual work.

Who Needs to Use the eInvoice Portal?

The e-invoicing requirement is being implemented incrementally. Currently, companies that turnover more than a given amount in a year are required to make e-invoices via the portal. It first began with firms whose turnover exceeded [?]500 crore, but the threshold was gradually lowered.

Even enterprises turning in excess of [?]5 crore today need to create e-invoices through the portal. This implies that even the small and medium businesses should implement the system to stay in compliance.

The eInvoice Portal is a portal characterized by the following key features.

The eInvoice Portal comes with several features that make it an essential tool for businesses:

- Invoice Registration Number (IRN): Each and every invoice issued in the portal is assigned a special IRN that authenticates its validity.

- Integration of QR Code: It creates a QR code to speed up the process of validating and verifying invoice details.

- Uniform Schema: The invoices have a standardized format by GSTN, which means that there is consistency.

- Real-Time Validation: IRP instantly validates the invoices and then it shares the invoices with the GST and e-way bill systems.

- Multi-Channel Access: Invoices can be uploaded by businesses via APIs or using bulk upload tools or accounting software that are connected to the portal.

- Data Security: The portal provides an encryption and secure storage of business sensitive data.

- Connection with GST Returns: invoice information gets transferred to GSTR-1, eliminating the need to repeat working.

How to Register on the eInvoice Portal

If your business meets the turnover threshold, you need to register on the eInvoice Portal. Here’s a step-by-step guide:

- Go to the eInvoice Portal: Visit the government eInvoice Portal.

- Log in using GST Credentials: You can use your GSTIN and password (as on GST portal) to log in.

- Create API User ID: You can create an API user ID in case you wish to connect your billing software to the portal.

- Choose Mode of integration: Depending on your preference, you can either do direct API integration, GSP (GST Suvidha Provider) integration, or have the option of manual upload, using bulk tools.

- Full Verification: When your credentials are being verified, then you can begin to generate e-invoices.

The e-Invoice Process

The workflow of creating an e-invoice on the portal is based on simple steps:

- Invoice Preparation: It is the task of businesses to prepare the invoice in their accounting or billing software.

- Upload to IRP: The invoice is uploaded into the Invoice Registration Portal on APIs or in bulk.

- Validation: The IRP verifies the invoice information and verifies duplication.

- IRN Generation: After validation, a unique IRN or Invoice Reference Number is created.

- QR Code Addition: A QR code with important invoice information is included to verify this information.

- Data Sharing: The validated invoice is also sent to the GST system, where it will be auto-populated into returns, and to the e-way bill system, where required.

- Final Invoice: This is the digitally signed invoice containing IRN and QR code sent back to the business.

Benefits of Using the eInvoice Portal

The use of e-invoice system has a number of benefits to the businesses, tax authorities, and the economy in general:

For Businesses

* Eased-up Compliance: There is no requirement to record the invoice data in two different uploads, including GST returns and e-way bills.

* Constant error Reductions: Automated validation can reduce the number of errors when invoicing.

* Quick Processing: Real time verification implies faster transactions.

* Easy Integration: Compatible with any ERP system, billing and accounting systems.

* Cost Savings: Saves paperwork, manual labor and compliance costs.

In the case of Government and Tax Authorities.

* Fraud Prevention: Removes bogus invoices and enhances better efficiency in collecting taxes.

* Greater Transparency: Transactions can be easily tracked and audits can be improved.

* Real-Time Monitoring: Real time access to invoice information to analyze.

For Customers

* Trust and Transparency: The customers have the standardized invoices that are easily verifiable.

* Faster Input Tax Credit (ITC): The invoices are verified online and, therefore, the ITC claims become more convenient.

Several Problems which are common when using the eInvoice Portal

Although the e-invoice system is promising in a variety of ways, a business can experience several difficulties on its way to adoption:

Technical Integration: Small businesses with a weak IT infrastructure might have a hard time integrating them with the portal.

* Training Needs: New invoicing processes should be trained to the employees.

* System Down: Like any online platform, there might be some down time, which can impact invoicing.

* Adaptation Costs: The businesses can be required to invest in updated billing software.

These difficulties may be reduced through proper planning, training the employees, and by engaging GST Suvidha Providers (GSPs) to assist in integration.

Hints to Ease the implementation of the eInvoice Portal

- Upgrade Billing Software: Make sure that your ERP/accounting software is able to support e-invoicing.

- Train Your Staff: Train properly employees who deal with invoicing and GST compliance.

- Test Before Live – Examine test invoices to check mistakes prior to the launching.

- Use GSP Services: In the case of small business, it is easier to have the integration with the authorized GSPs.

- Keep Informed: Monitor government announcements on changes in threshold and compliance dates.

It is often called the Frequently Asked Questions (FAQs).

- Does that mean that all businesses are required to do e-invoicing?

No, it will never be mandatory to businesses below a certain turnover threshold which is currently [?]5 crore.

- Can small businesses voluntarily use the eInvoice Portal?

Yes, the portal can be used by small businesses to make invoicing simpler, even though not compulsory.

- Do I have to have internet connection in order to create e-invoices?

Yes, because it is impossible without the internet connection as validation occurs via the IRP.

- What will be the case with not issuing an invoice with IRN?

According to the GST law such an invoice will be invalid, and penalties can be imposed.

- Can I cancel an e-invoice?

Yes, the e-invoices may be canceled in the first 24 hours of the chance of generation via portal.

Future of the eInvoice Portal in India

The e-invoice system is a move towards greater digital and transparent economy. It is anticipated that the government will reduce the threshold even more in the future, and will ultimately obligate all GST registered businesses to adopt e-invoicing.

Moreover, it will soon be possible to combine with artificial intelligence and automation tools, which will make the process of invoicing even quicker and mistake-free. It is probable that the eInvoice Portal will become a fully digital tax compliance ecosystem that will be beneficial to businesses and regulators.

Conclusion

The eInvoice Portal is not their compliance tool; it is a major step forward in the manner businesses handle invoices in GST. Having standardized invoicing, real-time validation, and GST returns integration makes it easier to comply with and enhance efficiency and transparency. To businesses, taking up the portal does not solely relate to the compliance requirement, but also includes the long-term financial gains such as savings, the minimization of error, and improved interconnection to digital systems. As the GST ecosystem in India is increasingly digitalized, the eInvoice Portal will remain very crucial in determining how businesses will cope with compliance and taxation. Keeping up and changing early will keep your business competitive, and in compliance in this digital-first economy.