Introduction

Digital revolution in India has introduced numerous changes in the business operation scenario and electronic invoicing has been recorded as one of the most significant changes. In this transition, the IRP Portal has become a central tool for ensuring smooth, accurate, and transparent invoicing under the Goods and Services Tax (GST) system.

It is no longer optional but important that accountants, business owners, and finance professionals know how this portal functions. In this article, we will explore what the IRP Portal is, why it was introduced, how it works, and why businesses should embrace it for long-term efficiency.

Understanding the IRP Portal

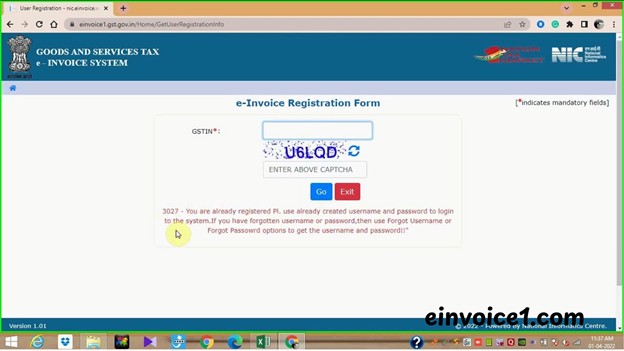

The IRP Portal, also known as the Invoice Registration Portal, is an official online system created by the Government of India. It is mainly used to authenticate and register electronic invoices, also known as e-invoices, issued by organizations. The information is posted in the portal whenever an invoice is created. The system will then check the information and provide a unique Invoice Reference Number (IRN) and a QR code which will hold the basic information of the transaction.

This would be done in order to make all the invoices standardized, checked and in a safe electronic digital form. The portal is very helpful in ensuring that the GST laws are adhered to by removing duplication and the chances of the portal being tampered with.

Why the IRP Portal Was Introduced

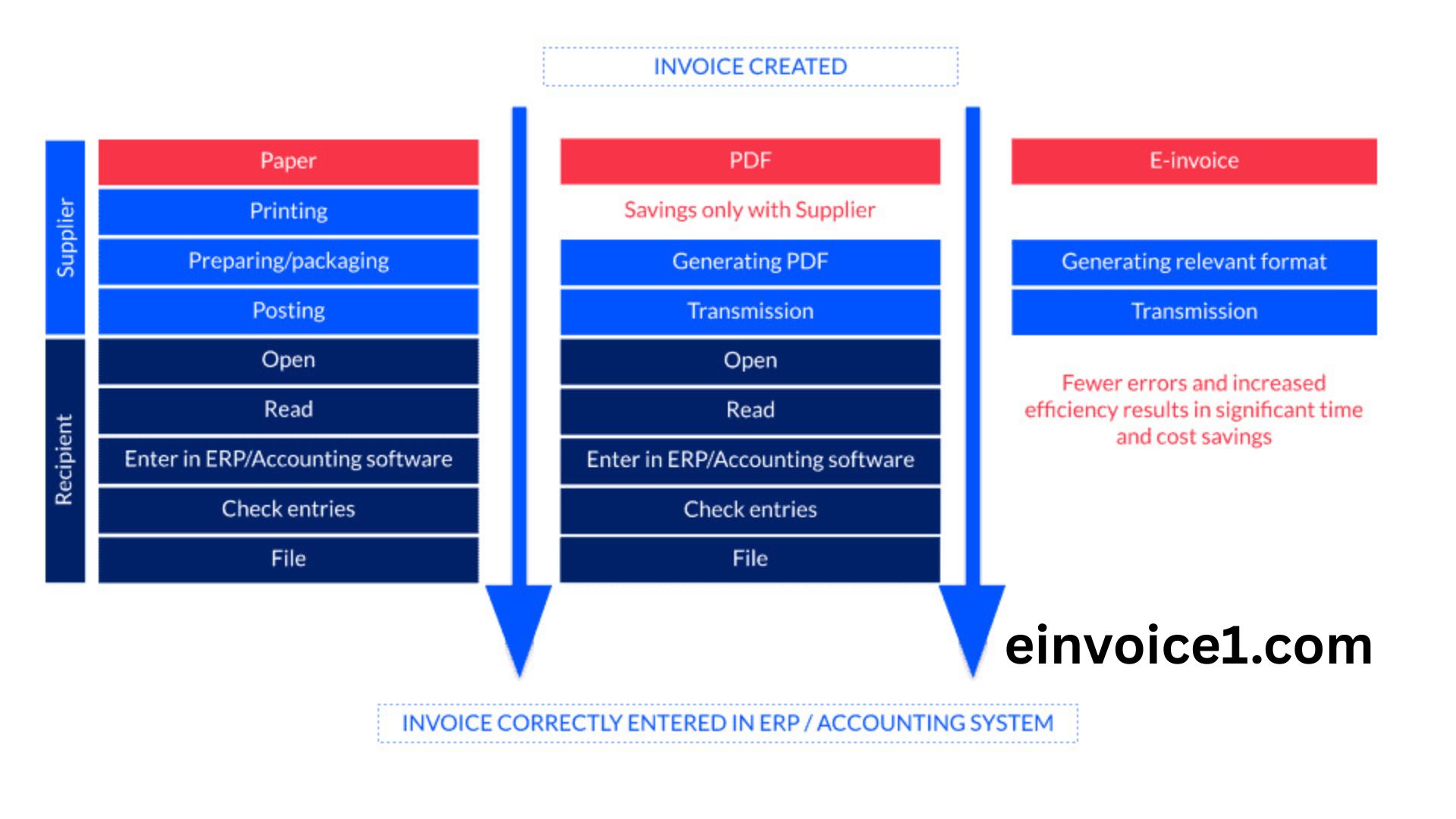

The majority of businesses created invoices by hand prior to e-invoicing. Mismatched entries, clerical mistakes, and even fraudulent activities were frequently the result of this. Additionally, tax authorities found it difficult to monitor invoices in real time, which led to opportunities for tax evasion.

By establishing a standardized procedure that benefits both companies and the government, the IRP Portal’s launch altered this environment. It guarantees transparency, minimizes errors, and lowers fraud. Additionally, it streamlines compliance, freeing up companies to concentrate less on paperwork and more on expansion.

Main Features of the Portal

One of the biggest strengths of the IRP Portal is that it offers real-time invoice authentication. The uploading of an invoice is automatically validated. An invoice reference number is given that no two invoices will ever have identical numbers. The generated QR code carries important information such as invoice number, date, GSTIN of buyer and seller and the amount total, facilitating verification in a very easy way.

The other observation is that it is directly linked to the GST system. The information posted on the portal automatically transpires on the GST returns and even connects with the e-way bill system, eliminating numerous entries. The fact that all data is encrypted and kept in safe places means that businesses are assured that their records will not be tampered with.

Who Needs to Use the IRP Portal

Not all companies must create electronic invoices. Only those who exceed the prescribed limit are required to comply with the government’s set turnover thresholds. The threshold has been progressively lowered over time in an effort to include more companies in the system. The mandate also applies to businesses involved in exports, business-to-business transactions, and other notified categories.

For example, a small local trader may not yet need to use the portal, but a large manufacturer or exporter would undoubtedly need to. To guarantee compliance, it is crucial to always review the most recent government notifications.

How the Portal Works

Using the IRP Portal may seem technical at first, but once businesses become familiar with the process, it becomes quite straightforward. The process starts with invoice preparation in the ERP or billing software of the company. Rather than handwriting it down or sending it directly to the buyer, first, the invoice information is converted into a defined format and uploaded to the portal.

The portal checks the information once uploaded. When everything is right, it produces a distinct Invoice Reference Number with a QR code. These are then returned to the busines,s which in turn can issue the final invoice to the buyer with the authentication information attached. At the same time, the information is passed to the GST system and, where needed, to the e-way bill system. This automatic flow makes compliance one of the least effortful tasks.

Benefits for Businesses

The IRP Portal has transformed the way companies handle invoicing. One of the most significant advantages is the reduction of human error. Since the system validates invoices in real time, chances of incorrect entries are greatly reduced. Compliance has become faster too, because data automatically flows into GST returns, saving valuable time during filing.

For many organizations, the portal has also brought financial benefits. Manual processes involve higher costs in terms of time, resources, and manpower. With e-invoicing, businesses save money while enjoying smoother operations. Another key benefit is transparency. Since every invoice is registered and verified, the scope for fraud or manipulation is minimal.

Common Challenges in Using the Portal

Like any technological system, the IRP Portal is not without challenges. Some businesses, especially smaller ones, find the initial learning curve a little steep. Technical glitches such as server downtime or failed uploads can occasionally cause delays. Incorrect data entered in the invoice may also lead to rejections, forcing companies to revise and re-upload.

Moreover, continuous internet access is essential, which can be a limitation in areas with poor connectivity. Despite these issues, most challenges can be overcome with proper training, updated ERP systems, and reliable internet services.

Best Practices for Smooth Usage

To get the most out of the IRP Portal, businesses should take a proactive approach. Educating the personnel on the utilization of e-invoicing means that the procedure proceeds without interruption. The other is that the accounting or ERP software should be integrated with the portal, and will not require manual uploading. It is also useful to check the data and submit it only after making sure that there are no unnecessary rejections.

As GST rules are revised periodically, organisations should always be aware of the current compliance requirements. It is also a good practice to keep duplicate copies of invoices, which act as a safety net during technical failures.

Role of Technology in Integration

Technology is crucial to the smooth operation of the IRP Portal for companies. Invoices can now automatically flow from internal systems because many businesses have already used APIs to integrate their ERP systems with the portal. In addition to saving time, this lowers the possibility of human error.

Additionally, cloud-based solutions have grown in popularity. They enable companies to handle billing without having to make significant investments in IT infrastructure. Smaller businesses that might not have sophisticated systems can use third-party apps or offline tools offered by the government to meet the requirements.

Looking Ahead: The Future of the IRP Portal

The scope of the IRP Portal is expected to grow in the coming years. As the government lowers the turnover threshold, even smaller businesses will eventually have to adopt e-invoicing. This move will lead to a fully digital ecosystem where every transaction is recorded in real time.

Future developments may also include features powered by artificial intelligence for fraud detection, more user-friendly dashboards, and deeper integration with international trade platforms. Such innovations will make compliance even easier while strengthening the credibility of Indian businesses on a global scale.

Why Businesses Should Adopt Early

This last-minute rush is not always the most effective approach when dealing with businesses that have not yet been drawn into e-invoicing. Early adoption of the IRP Portal gives companies the advantage of being well-prepared before compliance becomes mandatory. It enables them to test the systems, train employees, and have time to make process adjustments without the strain of deadlines.

In addition, organizations that adopt digital tools early-on usually become efficient, which keeps them competitive. Instead of accepting the portal as a regulatory burden, it is more appropriate to view it as a growth and modernization tool.

Conclusion

The IRP Portal has become an essential part of India’s digital taxation framework. It saves money, improves transparency and reduces errors since invoices are validated in real time and are compliant with GST laws. Though some difficulties might arise in accustoming to the system, the benefits of the system in the long-run are a lot higher than the challenges. As India moves closer to a completely digital economy, the role of the IRP Portal will only grow stronger. Those businesses that learn it and embrace it today will be in a better position to tackle the future of taxation and compliance. The portal is not only about rules, but about a smarter, faster and more transparent way of doing business, which applies to all companies regardless of their size.